Plans For Term Life Insurance

Is your family and loved ones prepared for your departure?

We all know that our demise is inevitable. Leaving your family prepared financially for your departure is one of the greatest things you can do to give yourself and your family peace of mind while you are still building your financial future.

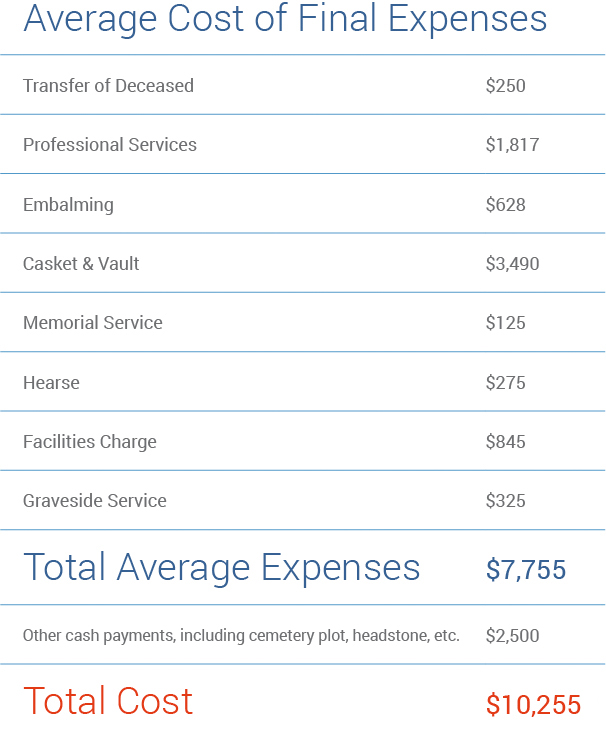

Term Life insurance is the most affordable way to protect your family with larger death benefit amounts over a specified period of time. It can help with things such as paying the mortgage, college tuition, credit card debt, final expenses, and other items that may be a financial burden to your family when you depart. Term Life insurance gives you the option to choose the length of time you need the protection. Typically, the length of term options range from 10,15,20,25, and 30 years.

Term Life insurance is especially effective during the years when you’re building a nest egg for retirement, paying off a home mortgage or putting away funds for your child’s college tuition.

Now more than ever, you need to take charge of your healthcare. Not only could your individual or family’s needs change, but insurance plans themselves can change: increased premiums, modified coverage due to changes to physician and hospital networks, or prescription drug coverage – to name a few.

Relax. We’ve got you covered

It can be overwhelming and time consuming to keep up with all these changes. But rest assured, SeniorQuote can help.

Your SeniorQuote Licensed Agent will take the time to understand your concerns and will patiently answer all your questions. Our agents are specialists about the issues that matter the most to you. You’ll get easy to understand, unbiased information to simplify finding and selecting the right policy and have confidence that you’re making the smartest choice for you and your family.

What’s more, SeniorQuote is licensed in all 50 states, and has the unique ability to help you shop more than 30 insurance carriers, doing all the legwork to thoroughly compare them for you. One call to a SeniorQuote Licensed Agent can get you the coverage you need at the best price possible.

What is the length of time I should Consider?

- 10 years

- 20 years

- 25 years

- 30 years

Consider how much time it would take for you to pay off your current obligations. This may help determine the amount of time you need for a term insurance policy.

How much Term Insurance do I need?

- $1 million

- $500,000

- 100,0000

- $50,000

When considering how much Term insurance is appropriate for you consider your Debt, Income, Mortgage, and Expenses. This will give you a good gage on the dollar amount that would be a good fit for your policy.