Medicare Supplement & Medicare Advantage

Which type of coverage is right for YOU?

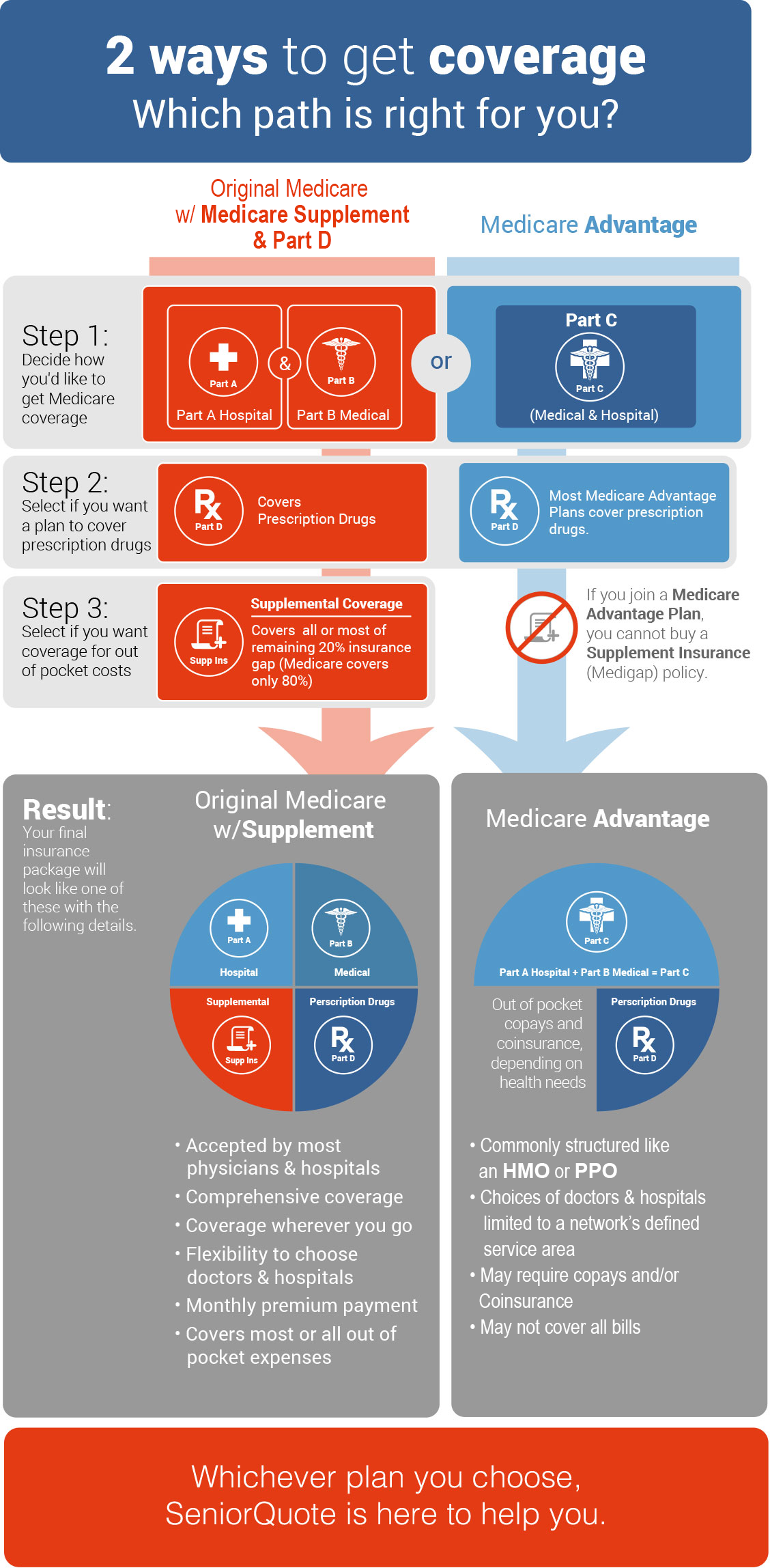

Before focusing on which plan to get with your Medicare, you should first focus on yourself. Medicare Supplements and Medicare Advantage Plans are two separate and distinct types of coverage. A beneficiary may not have a Medicare Supplement and a Medicare Advantage plan. This means that it is important to know which type of coverage suites you best. Here are some important factors–the ABCs–which you should consider before deciding whether Medicare Supplement or Medicare Advantage is the right option for you.

- Access – Do you have particular doctors or facilities you would like to retain access to? Would you want to have open access to any Medicare provider in the U.S. without the need of a referral? Or, are you open-minded to using any Medicare health providers in your area?

- Benefits – What benefits are important to you? Do you need coverage for things not covered by Medicare, such as prescription drugs, dental, vision & hearing?

- Cost – What is your budget? Would you rather pay a premium each month, to reduce your out-of-pockets costs later? Or, would you rather pay little to $0 each month, and “pay-as-you-go” with copays and coinsurance?

We make it easy to choose the plan that’s right for YOU

SeniorQuote simplifies this process in just three easy steps!

How much does Medicare insurance cost?

Did you know that where you live can affect how much your insurance will cost? Not only that, different carriers in the same area can also have different cost structures.

We’re here to help you

In a single phone call, a SeniorQuote Licensed Agent will carefully review your needs with you then help compare several insurance carriers in your area. Call us at 1-800-992-7724 or Request a Free Quote.