Plans for Final Expenses

Plan ahead to protect your family

Some things in life are really hard to confront. Making a decision about life insurance is often one of them.

For one thing, it makes us think about the possibility of dying and leaving our loved ones behind to sort things out after we’re gone. Another difficulty is comparing different insurance policies to make sure you are getting a policy that gives your family one less thing to worry about when they’re dealing with your loss.

Leave your family a legacy of love instead of medical bills and funeral expenses. A Whole Life policy is meant to protect you for the duration of your life and provide you with peace of mind that your final expenses will be taken care of.

*Fast Facts*

- Your premiums will never increase, even as you age.

- Your benefits will never be reduced.

- Your beneficiaries are covered for the duration of your life.

- Your policy will not be cancelled as long as you make the premium payment (policies are subject to a two year contestability period).

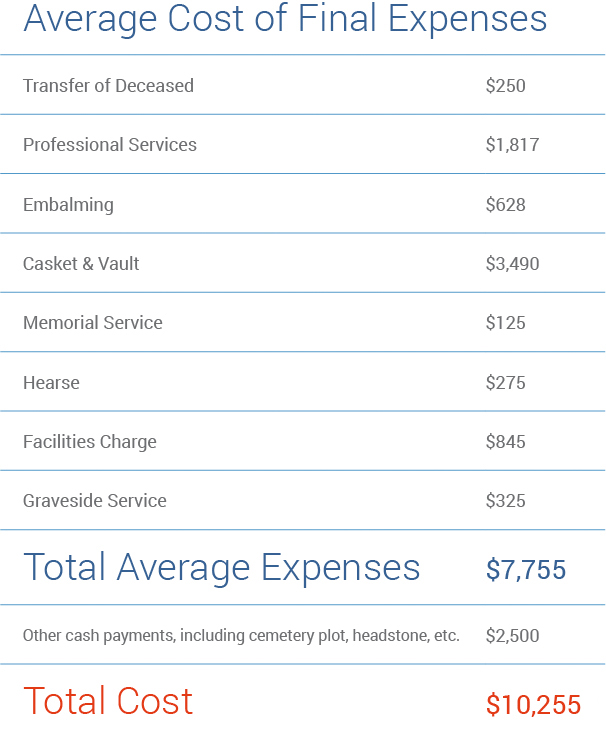

How Much Could Final Expenses Cost?

To help you pick the right type of insurance, call a SeniorQuote Licensed Agent who can find you what you need. Your new Whole Life insurance policy can be issued within days of application with no health exam by just answering a few short yes or no questions to help us get you approved with the right carrier.

You deserve to have the peace of mind that comes from knowing your loved ones are taken care of. Don’t put it off, call a SeniorQuote Licensed Agent today.